More Love From Warsaw: Bitspiration Festival, pt2

So the presentation that I was about to give when I wrote this post went over so well that they asked me to keep talking for another 20 minutes. Good thing I had another presentation ready to go… or almost ready to go to be precise. I was planning to give this presentation to the current DreamIt NY startups on Wednesday but hadn’t quite finished it yet so the version that went onscreen in front of 100+ startups in Warsaw had a slide saying “More Stuff Here” in lieu of slides 19-22!

So the presentation that I was about to give when I wrote this post went over so well that they asked me to keep talking for another 20 minutes. Good thing I had another presentation ready to go… or almost ready to go to be precise. I was planning to give this presentation to the current DreamIt NY startups on Wednesday but hadn’t quite finished it yet so the version that went onscreen in front of 100+ startups in Warsaw had a slide saying “More Stuff Here” in lieu of slides 19-22!

DreamIt, PitchIt, FundIt: Prospecting for Investors and the Art of the Elevator Pitch

Here’s a link to the (now complete) presentation:

https://slidebean.com/p/sNpHbL5eha/DreamIt-PitchIt-FundIt

(No, I don’t have mad presentation skills. I simply use Slidebean)

From Warsaw With Love: Bitspiration Festival

Landed in Warsaw a few hours ago, shaved, showered, grabbed a coffee, and headed over to the Palace of Culture and Technology where I’m scheduled to speak in less than 30 minutes. Good thing I’ve finished my presentation!

Landed in Warsaw a few hours ago, shaved, showered, grabbed a coffee, and headed over to the Palace of Culture and Technology where I’m scheduled to speak in less than 30 minutes. Good thing I’ve finished my presentation!

DreamIt, BuildIt, CrushIt: What accelerators do, do you need one, and how to chose the right one

Here’s a link to presentation: https://slidebean.com/p/D4qGyACtGs/DreamIt-BuildIt-CrushIt

I’m only in town for a day(!) but I’ll try to follow up with some thoughts about my trip in a few days.

UPDATE: This one went over so well, they asked me to keep talking!

(No, I don’t have mad presentation skills. I simply use Slidebean)

Are Accelerators Just Paid Introductions in Disguise?

It was not so much a debate as a “frank exchange”.

I was exchanging emails with the founder of one of the larger startup pitch conferences. He had asked me if I would promote his event with some of the DreamIt startups who are currently fundraising. His events are pay-to-pitch and it’s fair to say that, as a general rule, I’m not a fan of that model.

I (politely, I hope) explained my reservations. I’ve dealt with the issue in more depth here but the gist is that getting in front of key decision makers is a core competence for successful entrepreneurs. If you can’t get a warm intro to early stage investors who, by and large, are some of the most networked people on earth, how will you get in front of potential customers, distribution partners, etc.? Paying for access to investors often signals a lack of this core competence, and, more generally, an attitude that something so fundamental to their business should be outsourced.

When I was done explaining, he responded with this deceptively simple question:

“How is presenting at our program different then presenting at your demo day? Those companies pay you with equity. Couldn’t you make the point that if they need your services then they are [equally lacking]?”

Respectfully, I disagree. There is a world of difference between participating in an intense 3 month program where you master key skills vs. simply writing a check.

Putting aside the heavy filtering that is a result of the intense competition for admission into the top accelerators – having seen the numbers first hand, I can confirm that it is statistically easier to get into Harvard than it is to get into DreamIt – that in itself virtually guarantees a better pool of demo day startups than pay-to-pitch presenters, anyone who has been through a top accelerator will attest to how much they have learnt. In particular, the alumni who graduate from top accelerators leave the program fully capable of networking to investors, clients, partners, etc. Startups who use bankers or other intermediaries leave with some business cards. It’s the difference between mastering a skill and renting it, between going to med school or just going to the doctor.

But then again, I might be biased. 🙂

What do you think?

Angel Investing – Fools Rush In Where Family Offices Dare To Tread (1)

Note: This post originally appeared as an article on FOCAPNET.![]()

Angel investing is hot… and not just because it’s so cool.

When for over a decade single-digit Venture Capital returns qualify as “top quartile”, seed stage investments have generated 27% ROI. (2) So it is only natural that family offices and high net worth individuals are eager to get exposure to this sector. The only problem is, they often don’t have the experience they need to do it right.

Here’s a typical family office startup story:

- A family office decides it wants to get into angel investing.

- One of the investment professionals goes to a few meetups and generally gets the word out that he is in the market for interesting startups.

- He starts getting pitched (directly, via LinkedIn, etc.) by a host of “investment advisors” representing “hot startups”.

- A few of these startups look pretty good so the family office invests.

- These investments fail miserably.

- The family office decides that startups are a “bad investment” and goes back to what it was investing in previously.

Hint: Step 3 is where things ran off the rails. I’ll get back to that in a moment.

Why family offices are ill-equipped for angel investing

The more sophisticated family offices employ investment professionals who have deep experience analyzing the strategies and returns of public equities, hedge funds, private equity funds, etc. These are all well defined instruments, within generally limited investment universes, for which substantial data is available. Even if you are considering seeding a hedge fund or committing to a newly minted PE/VC fund, you can still mine the principles’ track for a fair number of data points. Furthermore, there are well-established channels for learning about new opportunities (e.g., “capital introduction” dinners) in these spaces.

Now reverse every single one of the above characteristics and you get angel investing. Every halfway decent startup opportunity is unique, solving unmet needs in different industries – sometimes in industries that don’t even yet exist. There are no registries or directories of startups, no associations to join. And you can forget about data entirely with a pre-revenue company. At best the founders have one or two reasonably successful prior ventures under their belts. (If they had a real home run under their belts, they wouldn’t need investors at all.) Furthermore, the best way to find great startups to invest in is to know other great startups so if you aren’t already deep in that community, you’re already disadvantaged.

Unfortunately, most family offices don’t realize how fundamentally different early stage investing is from other alternative asset investments. So they don’t see anything amiss when investment adviser brings them startups to invest in. (I told you I’d get back to step 3.) They are used to meeting emerging hedge fund managers that way so why shouldn’t they find a great startup that way too? Because the best startups are never, ever represented by an investment advisor.

Think about it. VCs are the most networked people on the face of the earth. VC present at panels or judge pitch events practically every week. They meet dozens of entrepreneurs every week and know – and have often co-invested with – virtually every other VC in our area. If a startup founder can’t network his way into a warm introduction to a VC or angel, how is he going to find customers or key strategic partners? Is this advisor going to be holding his hand then too, after your check has cleared? Plus, the very fact that the founder thinks he can waive his hand and simply have someone else take something this crucial to his business for him is huge red flag in and of itself. So any startup that has an investment advisor fundraising for them is already automatically suspect. In practice, the deals the family offices are being shown by these advisors are the hairy, old, over-shopped deals that every VC and halfway serious angel have already turned down. It’s no wonder they fail miserably.

To be fair, to the untrained eye they don’t look that bad. Perhaps they have a cool piece of ad tech that you are convinced will take agencies by storm. You have to really know the industry to understand why agencies turned them down two years ago when they first tried shopping their solution around. That fantastic social media marketing tool? It’s so wonderful that five other companies are already doing it and they are all making better progress than the one you were pitched. But if you aren’t seeing dozens of startups each month, there’s no way you could be expected to be on top of all these trends.

So what’s a family office to do?

In theory, a family office could hire a seasoned angel investor to invest on their behalf. But good luck finding one. Many angels are running their own businesses and/or are entrepreneurs who had a large exit and have no interest in working for a family office. Also, angel investing is a numbers game. Most startups will fail, and many of the rest will be modest successes. You have to invest in many, many startups to have a reasonable chance of 1 or 2 of your investments being a home run. There’s a reason Dave McClure named his fund (now an accelerator as well) “500 Startups.”

Fortunately, there’s a better option: Startup Accelerators.

Accelerators(3) are the boot camps of the startup ecosystem. Companies accepted into top accelerators are the very best, earliest stage startups in the world. The top accelerators typically get hundreds of applicants for just 10-15 spots. Having just run the screening process for DreamIt NY’s summer 2014 program I can personally attest that this is no exaggeration. The odds of getting into Harvard are slightly better than getting accepted into DreamIt.

Accelerators give the startups they accept a little cash ($20k-$40K on average), co-working space for the duration of the program (typically 3-4 months), and extensive mentoring, coaching, and introductions. Finally, on “Demo Day” the startups graduate by pitching their business to an audience of hundreds of active angel investors hand-picked by their accelerator. In exchange for all this, the accelerator gets equity in the startup (usually 6-8%) and the right to co-invest in the startup’s seed round.

From the perspective of the family office, accelerators can be the capital introduction dinners for startups. Unlike the shady investment advisors discussed above, accelerators are personally invested in the startups they accept. Accelerators do not get commissions on the fund they help their startups raise; they only profit when their portfolio companies have an exit so their incentives are aligned with the other angel investors.

But they are more than just a trusted recommendation from a fellow angel investor. Accelerators like 500 Startups, DreamIt, TechStars, and Y Combinator invest in dozens of startups each year and can bring a structure and rigor to the investment process that few angel investors have. Established accelerators bring unparalleled networks and reputation to the table enabling them to source the very best new companies out there.

Many accelerators are structured much like VC funds. But there is one crucial difference: co-investment. Even the most co-investment friendly VCs only make their portfolio investments available to LPs if they are unable or unwilling to invest their full pro rata. If it’s a great portfolio company, the VC will continue to invest until it runs out of powder or starts bumping up against position caps. And if the VC is able to but does not want to exercise its full pro rata, do you really want a bigger stake in that company? In both cases, the VC eats first and the LPs get leftovers.

Accelerators on the other hand, rarely invest in more than a small fraction of the portfolio company’s seed round. As I mentioned above, early stage investing is a numbers game so they reserve most of their investment capacity for new startups. As a result, 75% or more of the round goes to new investors.

Think about that for a moment. Here’s an entity that filters out 98% of the startups they see, takes the top 2% and gives them all the help a young company could ask for, and then willingly steps aside and lets any other angel or VC swoop in and invest in those elite new ventures. No commissions, no membership fees. Wow.

If all a family office did was go to the Demo Days of the top 4 or 5 accelerators and invest in the presenting startups, the filtering effect alone would give them a high quality portfolio of early stage investments, no additional effort required.

For the family offices who want to build their own experience base and startup network, there is an even better option: invest directly in the accelerator. Accelerators typically give their LPs early access to their new class so LPs can track a startup’s progress over a longer period of time before deciding to invest and/or can invest before Demo Day and avoid the risk of missing out on the hottest prospects. Furthermore, most accelerators will gladly explain their selection process, describe how they are assisting the startups, and introduce LPs to other members of the startup community. This practical education is not something you can buy anywhere but you can get it for free simply by investing in something you already want to invest in.

Investing directly in a top accelerator also makes sense from an efficiency perspective. Even investing the bare minimum $25K per startup (and some startups insist on $50K or $100K minimums), creating a portfolio of 100-200 startups would cost a family office $2.5M-$5M. But this leaves no money for follow on investments. As a rule of thumb, you want to set aside $1 for follow on investments for every $1 initially invested so getting that 100-200 startup portfolio actually means committing $5M-$10M to early stage investing. In contrast, you could invest $1M (4) into the accelerator’s fund for the same portfolio of 100-200 startups, including follow on investments. That comes out to just $5K-$10K per portfolio company.

So let’s re-write the family office story:

- A family office decides it wants to get into angel investing.

- It researches the accelerators in its area and invests in 1 or 2 of them.

- It spends the first few accelerator cycles learning the ropes and making connections.

- As it gains confidence, the family office invests directly in a few of the accelerated startups, effectively doubling-down on a few, high conviction plays.

- The diversified portfolio does well

- The family office makes disciplined, intelligent, efficient angel investing a formal part of its allocation strategy

Now how’s that for a happy ending?

(1) Just in case you were wondering, “For fools rush in where angels fear to tread” was first written by Alexander Pope in his poem An Essay on Criticism.

(2) Right Side Capital analysis of eight large studies of historical angel investing returns in the US & UK (http://rightsidecapital.com/assets/documents/HistoricalAngelReturn.pdf)

(3) Sometimes called incubators, although incubators are more often shared co-working spaces with some additional services that are of value to startups. Unlike accelerators who rigorously screen their applicants, incubators are generally open to all, space permitting, as long as they can pay the rent.

(4) Many accelerators will allow family offices to invest as “individuals” rather than “institutions” enabling them to qualify for minimum investments of $500K or even as low as $250K, which comes out to as little as $1,250 per startup(!)

100% of Nothing

“We are just not sure it’s worth 6% of our company.”

Accepting the position of Managing Director in charge of DreamIt’s NY startup accelerator meant a lot of things, two of which include:

- Meeting a lot of really, really interesting startups 🙂

- Far less time for blogging 😦

One recent experience cut right to the core of the accelerator experience and has been bothering me so much that I’m going to share it despite having far more pressing items to handle in the one week I have left before DreamIt NY Summer 2014 kicks off.

We receive hundreds upon hundreds of applications for the summer accelerator cycle and meet with (in person or via Skype) over 50 of them before winnowing them do to the 10-15 companies we accept into this program. Despite the long odds – you are actually statistically more likely to get into Harvard than DreamIt! – you may be surprised to hear that not every company we extend an offer to ultimately accepts. Most of the (small) handful of companies who decline do so because they want a few more months to work on their business before entering our program. As DreamIt has accelerator programs every few months, our philosophy in these cases is generally, “We liked you now, we’ll love you even more after 3 months of further progress.” So if I’m sad not to have them in DreamIt NY Summer 2014, my colleague Patrick FitzGerald will be thrilled to have them in DreamIt Philly Fall 2014.

One of the startups we accepted, opted to go into a different accelerator program. We ‘win’ far more than we ‘lose’ but I won’t pretend this doesn’t happen from time to time. I think they made a mistake, especially given the nature of their business and the industry they are in, but the other accelerator runs a good program as well. So now I know how Harvard feels when a student they accepted goes to Yale instead. This isn’t the situation that bothers me.

One startup we accepted signed the offer letter and we both began making plans for the summer. Then I get a call from the founder to say she was having second thoughts. Would we be able to find the right mentors for her startup? Could we make useful industry connections? By the end of the call she stated that her team felt that they would rather just continue working out of her parents’ basement than give up 6% of their company to an accelerator.

Let’s ignore the fact that these were all questions that should have been asked before signing our offer letter – ideally even before applying to an accelerator program – and focus on the core complaint: is an accelerator program worth 6% of our company? For the answer to be Yes, a very simple equation has to hold true:

EV(startup+accelerator)*94% > EV(startup)*100%

In other words, is the Expected Value of 94% of your startup with the accelerator’s help worth more than the Expected Value of 100% of your startup without any help?

So how do we think about the Expected Value of a startup? Let’s simply the problem with some hypothetical numbers. Let’s assume that a “success” means that your startup sells for $100M and that the “odds” of success are 1:100 or 1% (note: I’m a huge fan of making the math easy). In this case:

Expected Value = $100M * 1% = $1M

(hmm… I wonder if this is why so many priced seed rounds are at a $1M pre?)

So for the accelerator to be at least as good a deal as going it alone, the odds of success have to be high enough to get you to a $1M+ Expected Value despite giving up 6%. Let’s whip out the calculator and solve for x:

94% * $100M * x% = $1M

x% = 1.064%

So, whether they understood this or not, what this startup was saying is, “We think your accelerator cannot increase our odds of success by even 7 one-hundredths of a percent.” Wow.

Now there are a lot of new accelerators out there and I firmly believe that some (many?) of the newer ones with no track record of nurturing successful startups, no real network of experienced, well-connected mentors, no built-in audience of hundreds of active angel investors – these accelerators probably cannot move the needle when it comes to increasing a startup’s odds of success. In fact, entering into a poorly regarded accelerator may even reduce the odds of success due to the negative signal. But to think this about an accelerator with a six year history in five cities where over one third of our ‘graduates’ have collectively raised over $115M and who are now worth in aggregate over $410M, that’s mind boggling.

Now I like these entrepreneurs and I honestly and truly hope they succeed despite this decision but I fear that they have just made a horrible mistake.

Thanks for letting me get that off my chest. Now back to work!

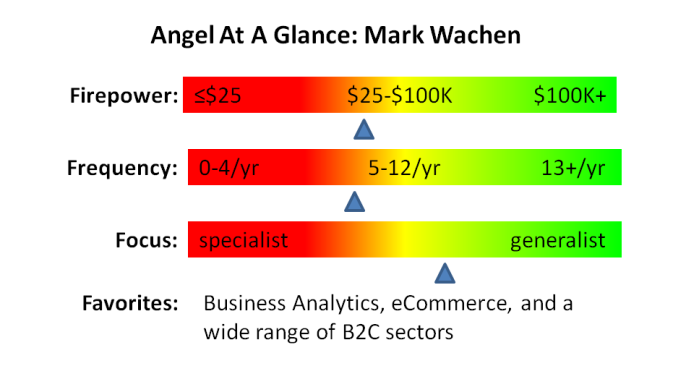

Angel Profile: Mark Wachen

![]() Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Mark Wachen is the Managing Director for DreamIt Ventures New York and the Managing Director and Founder of Upstage Ventures.

What got you into angel investing?

Mostly my experience with my own company, Optimost. [Acquired by Interwoven, which was in turn acquired Autonomy Corporation, which was bought by HP]. When I started that company, I raised some angel money. The role that those initial angels played was instrumental to the company’s success. The ability to contribute that same experience to other entrepreneurs to me is intrinsically valuable. Also, I am a big booster of the New York tech scene, and one of the key reasons for its growth in recent years has been the much stronger group of angels and the early seed money that is now available. It really helped ignite the whole thing. Like Bruce Springsteen says, “You can’t start a fire without a spark.” Angel investing is the spark that gets the whole thing going.

Certainly I hope there will be real economic returns from my angel investing but that’s not the only motivation.

What was your first angel investment and how did it turn out?

The first one was a company called Order Groove. They are basically a subscription commerce platform allowing eCommerce sites to offer recurring orders-of-the-month club functionality to their websites. I invested in 2009 and they are doing really well. They just raised a Series B round and have clients like L’Oreal, Jockey, Johnson & Johnson, Grainger, and others.

It really resonated with me because they faced some of the same challenges I faced in the early days of Optimost. Early on they faced the question, “Why can’t companies just build this themselves?” What I’ve learned from my own experience is that, while probably anyone can build anything with enough time and resources, none of these big companies have the time or focus to do it. So if you can provide a critically valuable service, they will gladly pay to have someone else provide it.

What investment do you most want to brag about?

(laughs) It’s hard to say who your favorite child is. I guess I have to pat myself on the back that virtually all of my angel investments are still in business. I consider that an accomplishment.

One that I think is particularly interesting is YouNow. They are a next generation, interactive television platform. There offer a huge variety of channels where people perform for a minute and the audience votes thumbs-up / thumbs-down. If the performer gets enough votes, he gets another minute.

What’s exciting to me is that it seems like the logical progression of where interactive entertainment is going. They are doing really well and now have a large number of channels going 24/7, with all kinds of interesting content. And the fact that it is crowd-curated means that quality should just keep getting better.

Notable lessons learned?

I had one train wreck. It’s still going but it’s a train wreck. This was a movie deal. I certainly learned the lesson “invest in what you know” because there was a lot about that particular industry that I wasn’t aware of. And, at least in this particular case, the level of unprofessionalism and mismanagement was the kind of thing you read about (laughs) or see in movies.

What’s the main reason you see for startups you backed, either personally or through DreamIt Ventures, that should have hit but didn’t?

At least for early stage companies, the common theme is usually team dynamics – not that it is not a quality team but that the founders don’t get along with each other and that causes the whole thing to implode. We as investors are constantly talking about how you need a well-balanced team with all these different skill sets and the side effect of this is that sometimes, in an effort to satisfy investors, it inadvertently leads to shotgun marriages, which are usually not a recipe for success.

Most humbling experience (relating to angel investing)?

The most humbling are the ones that get away, the ones that for whatever reason I decided not to invest in and that I kick myself for now. One I can mention is Birch Box. I met the women who run that right when they had the idea, before they graduated from Harvard Business School. They were a really impressive team and had a really novel idea. The challenge I had was that they were going after a category, women’s cosmetics, that I just didn’t have domain expertise in so I had a hard time wrapping my head around the market. But they checked out really high in every other metric and they seem to be doing really well.

How has running DreamIt NYC affected your angel investing?

They complement each other really well. My own angel investing, while in the grand scheme of things are certainly very early stage, within the spectrum of early stage, are not quite as early as DreamIt’s investments. A company that is coming into DreamIt is probably too early for me. I would probably think it needed more traction. So it works out quite well. If they are too early to me, they may be a great fit for DreamIt.

What’s the smartest thing someone you invested in did?

One of my investments is a company called Thumb [recently acquired by YPulse]. They basically provide real-time feedback on anything. The speed is astounding, meaning that you post the question and within minutes you can have a hundred responses.

When I met with the CEO, Dan Kurani, early on, the product demo was the perfect example of actions speaking louder than words. In the meeting, I asked questions on Thumb about random topics and within minutes answers started coming in. Experiencing the product in real-time was just an incredible proof of concept.

What’s the dumbest thing entrepreneurs do?

The kind of continuous dumb mistake I see is companies reaching out to me without doing any homework at all. Just because our names show up on a list of top angel investors does not mean we are going to be interested in what they have. There is such an enormous difference between just reaching out via LinkedIn blindly versus providing a rationale for why you are specifically targeting me because of something in my background.

What makes you better, more helpful, more desirable, etc. to a startup than the average angel?

First of all, I’ve walked in their shoes because I was an entrepreneur myself, raised angel money, grew my company to 85 people, and exited. On the flip side, as an investor and even prior to starting my company while I was at Sony, I sat on the side of the table with VCs and other professional investors. So I think I bring a multi-dimensional perspective on what an entrepreneur might be thinking – what are the things that motivate and are important to an entrepreneur – as well as what’s important to an investor.

What kind of returns do you aim for and how do you track ROI?

I don’t have a precise mathematical model but I’d like to feel confident that there is a reasonable path to at least a 10x return. My expectation is that it could be five years before I see a return. I know it takes time.

I’ve only had one exit so far, Chai Labs [acquired by Facebook] and the rest are still in progress.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

Self driving cars. I expect this to become much more mainstream. Even though it may be hard for people to wrap their heads around, the ability to make that time in the car productive is very valuable. And the technology is already strong.

What’s the best way for entrepreneurs to reach out to you?

LinkedIn… but read my bio first! You can also see my AngleList profile for more background.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here.

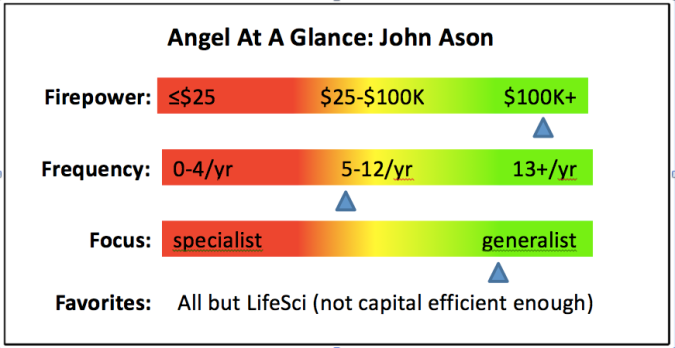

Angel Profile: John Ason

![]() Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. John’s profile went up a few weeks ago but I haven’t had a chance to post it here until now. Here’s the original article.

Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. John’s profile went up a few weeks ago but I haven’t had a chance to post it here until now. Here’s the original article.

What got you into angel investing?

I came out of AT&T Bell Labs, doing bleeding edge technology for 10 years, and then marketing and business management of large telecommunications projects sold overseas. So when I left, this was a natural extension of what I was doing AT&T. I made money in the stock market and apply the same discipline to angel investing: sell the losers and double down on the winners. Getting out of an investment is very difficult for most angels when the company is no longer viable as opposed to putting more money into it. I also play poker and most angels and entrepreneurs are good poker players.

What was your first angel investment? How did it turn out?

It’s either Xlibris or TuckerToys, I can’t remember. Xlibris, the first self publisher on the internet, sold about three years ago at a very nice profit. TuckerToys makes the Phlatball – over 15M sold, mostly overseas. TuckerToys produced a couple of great years of dividends and is still in existence.

What investment do you most want to brag about & why?

The two companies I am most famous for are Diapers.com and Bikini.com. People used to make fun of me for investing in Diapers.com because we were selling diapers on the internet… until Amazon bought it for $545M. And the really neat part was that I contributed absolutely zero to it, other than money and encouragement. It was like watching a really good movie. Marc and Vinit were super operational people and did not need any advice.

I like to mention Bikini.com because that humanizes me as an angel investor as opposed to those money hungry number crunching VCs. I need to have some fun too!

Notable train wrecks and lessons learned?

I’m proud of some of my train wrecks because I learned things from them. For example, MakeUsAnOffer was doing exceptionally well and then we got into some legal patent issues. We were probably in the right but couldn’t survive the lawsuit. Some things can’t be anticipated or planned for and you just don’t have the resources to handle.

Tell me about the startups that got away?

Never had one that got away. The closest I came to this was a company I wanted where a big VC did not want any other outside investors to get in. Ultimately, I got in indirectly through a VC fund where I am a limited partner. In most cases, the startups are just starving for cash; it’s almost always never the issue that it is so oversubscribed that you cannot get in.

Most humbling experience (relating to angel investing)?

Coming from Bell Labs, I assumed I could make anybody a good manager. But you can’t. At best you can influence them four or five degrees. You simply can’t make someone a good manager. That was my first humbling experience.

What impresses you about an entrepreneur?

I like someone who is clear, concise, compelling and elegant. I like to see an executive summary that fits on a single page with a lot of white space. And I love an idea that I have never seen before. Most ideas are retreads or rehashes.

Hotlist especially made an impression. They had amassed a massive database on events that people had gone to, were going to, or would be going to and there is a lot of location based services one can offer having that information. I had researched this area by doing due diligence on a few companies. Hotlist just had everything buttoned down and I made my decision in 28 minutes.

What turns you off to an entrepreneur?

Whenever people use the word “conservative” or “next generation.” I have a secret dictionary of these words which earn demerits and can disqualify the entrepreneur. This is how I “gamify” my investment process.

What makes you different from the average angel?

I like to invest in only industries that I know nothing about and I generally “let the dogs run.” I offer light overall guidance and try to introduce them to people who can help them. I am not an invasive investor.

Also, I mentor a lot. I have mentored companies which I did not invest in because they didn’t need the capital. I do it pro bono, because most entrepreneurs are nice people and in return I learn from the experience. I currently mentor 10 to 15 companies like this. They call me every four to six months for some advice or guidance and it’s usually a 15 to 20 minute session so it’s not a real time burner.

Recently, I’ve begun to mentor a number of international companies through Springboard and the Worldwide Investor Network. I also mentor women entrepreneurs through Astia & Springboard as well as women angel investors within Pipeline Fellowship, Topstone Angels, and 37angels. I have funded 11 female-founded companies, five of women were foreign born.

What financial returns do you target for an angel investment?

I aim for 10x returns. I say I want it within 3-5 years… although that’s never been achieved.

You have been angel investing for 17 years. How has it changed since you first started?

There has been a dramatic change over the past two or three years.

- The costs of starting a company are close to zero.

- The cost of proving the market with landing pages – sign up for the beta, sign up for a newsletter, answer a survey, stuff like that – is also close to zero. You can prove that there is a market without having a product.

- AngelList. I used to do 1 to 2 deals a year, very painfully. Finding a company was a big problem. Now AngelList has close to 19,000 startups on it so finding startups is not an issue. So is finding investors. In the past I used to syndicate deals. In my first 10 years, I knew everyone who invested with me intimately. Now, I tell my founders to list the company on AngelList with me as an investor and they assemble the rest of the syndicate. The majority of the other investors in my current deals are people I have never met.

- Accelerators like ERA, DreamIt and TechStars are producing large numbers of high quality, fundable companies.

- Super angels and micro VCs like John Frankel’s ff Ventures have a lot of cash for angel level companies, assisting in the fundraising process in a very positive way.

- Deal size. The average round until about a few years ago was $250K-$275K. It is now close to $650K. Many of these companies will skip their A round.

- International. The biggest response to my website comes from overseas asking me how they can invest in my companies and be angels in general. I received four investments into my companies. I have also received interest from foreign government organizations and universities on how to foster startup and angel ecosystems. We are also seeing a large number of foreign companies seeking funding.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

Brainwave chips. There are several startups that let you control your computers with brainwaves and they are starting to get a little bit of traction. They have various devices that go over your head and with this one can control a device that provides input to a computer. As this industry matures miniaturization will occur that will lead to a brain chip.

Will they really implant these chips in their heads?

Why not? I have a defibrillator. I don’t want to carry one around so I had it implanted. They could put it on sunglasses, but fashion will win out and they will ultimately be implants.

What’s the best way for entrepreneurs to reach out to you?

Email me at ason@comcast.net but read my website first!

Also, check me out on AngelList, Linkedin, Twitter, Pinterest, Spling, Tip or Skip, & PRESSi.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here.