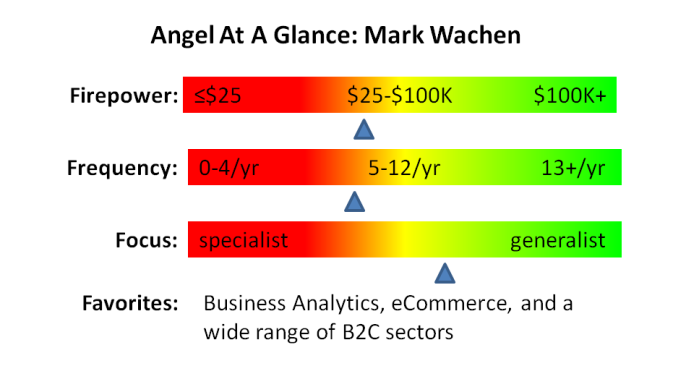

Angel Profile: Mark Wachen

![]() Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Mark Wachen is the Managing Director for DreamIt Ventures New York and the Managing Director and Founder of Upstage Ventures.

What got you into angel investing?

Mostly my experience with my own company, Optimost. [Acquired by Interwoven, which was in turn acquired Autonomy Corporation, which was bought by HP]. When I started that company, I raised some angel money. The role that those initial angels played was instrumental to the company’s success. The ability to contribute that same experience to other entrepreneurs to me is intrinsically valuable. Also, I am a big booster of the New York tech scene, and one of the key reasons for its growth in recent years has been the much stronger group of angels and the early seed money that is now available. It really helped ignite the whole thing. Like Bruce Springsteen says, “You can’t start a fire without a spark.” Angel investing is the spark that gets the whole thing going.

Certainly I hope there will be real economic returns from my angel investing but that’s not the only motivation.

What was your first angel investment and how did it turn out?

The first one was a company called Order Groove. They are basically a subscription commerce platform allowing eCommerce sites to offer recurring orders-of-the-month club functionality to their websites. I invested in 2009 and they are doing really well. They just raised a Series B round and have clients like L’Oreal, Jockey, Johnson & Johnson, Grainger, and others.

It really resonated with me because they faced some of the same challenges I faced in the early days of Optimost. Early on they faced the question, “Why can’t companies just build this themselves?” What I’ve learned from my own experience is that, while probably anyone can build anything with enough time and resources, none of these big companies have the time or focus to do it. So if you can provide a critically valuable service, they will gladly pay to have someone else provide it.

What investment do you most want to brag about?

(laughs) It’s hard to say who your favorite child is. I guess I have to pat myself on the back that virtually all of my angel investments are still in business. I consider that an accomplishment.

One that I think is particularly interesting is YouNow. They are a next generation, interactive television platform. There offer a huge variety of channels where people perform for a minute and the audience votes thumbs-up / thumbs-down. If the performer gets enough votes, he gets another minute.

What’s exciting to me is that it seems like the logical progression of where interactive entertainment is going. They are doing really well and now have a large number of channels going 24/7, with all kinds of interesting content. And the fact that it is crowd-curated means that quality should just keep getting better.

Notable lessons learned?

I had one train wreck. It’s still going but it’s a train wreck. This was a movie deal. I certainly learned the lesson “invest in what you know” because there was a lot about that particular industry that I wasn’t aware of. And, at least in this particular case, the level of unprofessionalism and mismanagement was the kind of thing you read about (laughs) or see in movies.

What’s the main reason you see for startups you backed, either personally or through DreamIt Ventures, that should have hit but didn’t?

At least for early stage companies, the common theme is usually team dynamics – not that it is not a quality team but that the founders don’t get along with each other and that causes the whole thing to implode. We as investors are constantly talking about how you need a well-balanced team with all these different skill sets and the side effect of this is that sometimes, in an effort to satisfy investors, it inadvertently leads to shotgun marriages, which are usually not a recipe for success.

Most humbling experience (relating to angel investing)?

The most humbling are the ones that get away, the ones that for whatever reason I decided not to invest in and that I kick myself for now. One I can mention is Birch Box. I met the women who run that right when they had the idea, before they graduated from Harvard Business School. They were a really impressive team and had a really novel idea. The challenge I had was that they were going after a category, women’s cosmetics, that I just didn’t have domain expertise in so I had a hard time wrapping my head around the market. But they checked out really high in every other metric and they seem to be doing really well.

How has running DreamIt NYC affected your angel investing?

They complement each other really well. My own angel investing, while in the grand scheme of things are certainly very early stage, within the spectrum of early stage, are not quite as early as DreamIt’s investments. A company that is coming into DreamIt is probably too early for me. I would probably think it needed more traction. So it works out quite well. If they are too early to me, they may be a great fit for DreamIt.

What’s the smartest thing someone you invested in did?

One of my investments is a company called Thumb [recently acquired by YPulse]. They basically provide real-time feedback on anything. The speed is astounding, meaning that you post the question and within minutes you can have a hundred responses.

When I met with the CEO, Dan Kurani, early on, the product demo was the perfect example of actions speaking louder than words. In the meeting, I asked questions on Thumb about random topics and within minutes answers started coming in. Experiencing the product in real-time was just an incredible proof of concept.

What’s the dumbest thing entrepreneurs do?

The kind of continuous dumb mistake I see is companies reaching out to me without doing any homework at all. Just because our names show up on a list of top angel investors does not mean we are going to be interested in what they have. There is such an enormous difference between just reaching out via LinkedIn blindly versus providing a rationale for why you are specifically targeting me because of something in my background.

What makes you better, more helpful, more desirable, etc. to a startup than the average angel?

First of all, I’ve walked in their shoes because I was an entrepreneur myself, raised angel money, grew my company to 85 people, and exited. On the flip side, as an investor and even prior to starting my company while I was at Sony, I sat on the side of the table with VCs and other professional investors. So I think I bring a multi-dimensional perspective on what an entrepreneur might be thinking – what are the things that motivate and are important to an entrepreneur – as well as what’s important to an investor.

What kind of returns do you aim for and how do you track ROI?

I don’t have a precise mathematical model but I’d like to feel confident that there is a reasonable path to at least a 10x return. My expectation is that it could be five years before I see a return. I know it takes time.

I’ve only had one exit so far, Chai Labs [acquired by Facebook] and the rest are still in progress.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

Self driving cars. I expect this to become much more mainstream. Even though it may be hard for people to wrap their heads around, the ability to make that time in the car productive is very valuable. And the technology is already strong.

What’s the best way for entrepreneurs to reach out to you?

LinkedIn… but read my bio first! You can also see my AngleList profile for more background.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here.

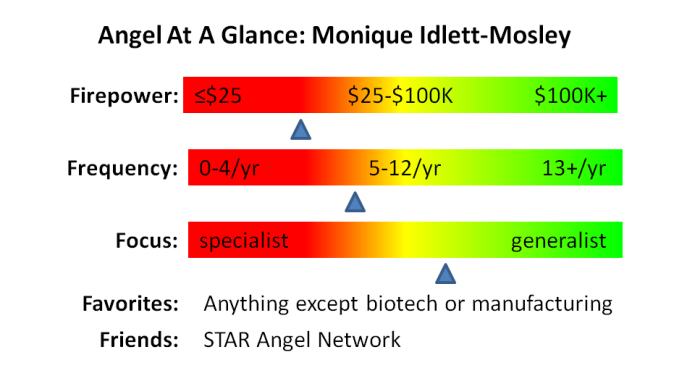

Angel Profile: Monique Idlett-Mosley (with Erica Minnihan)

![]() Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Note: Monique Idlett-Mosley is Co-President of Mosley Music Group and the wife of Timbaland. She was joined by Erica Minnihan, Executive Director at STAR Angel Network. Unless otherwise noted, all responses are by Ms. Idlett-Mosley.

What got you into angel investing?

We have a number of financial advisors who are extremely are great at what they do. They’ve brought some amazing opportunities to our door. However, I wanted to take more of a hands-on approach to expanding our portfolio and STAR Angel provides just that. It’s exciting to hear about things before everyone else does, to get in at an early stage where you can actually sit in the room when exciting, genuine ideas are being thrown around, and you feel a part of something.

That’s why STAR Angel Network is so important: it provides me with the opportunity to support new and innovative companies that are eager to make their mark on the world.

Tell me more about STAR Angel Network?

Erica: We are based in several cities and cater to current and retired professional athletes and celebrities. We launched in May 2012 and at this time, we have 50 members. The STAR Angel Network grew out of an Executive MBA program that our parent company, STAR Industries, owned. Monique was in their inaugural class. My business partner, Michael Lythcott, realized that a lot of the students in the class were making private investments, but that there was a lack of discipline. They were getting some dealflow, but they didn’t have an overall exposure to what was out there. They were getting things referred in from friends, but did not have a holistic approach to evaluate several opportunities against each other. The goal of STAR Angel Networks is to allow everyone to share dealflow; to allow everyone to participate in the investment analysis process; to have professional due diligence on each of the deals; and to get our members actively involved in the companies on boards, using their access and influence to help create value for our portfolio companies. Lastly, we want to give our members portfolio diversification which some people don’t realize is so important when you are investing in this kind of high risk, high return asset class.

What was your first angel investment?

Bespoke Post was one of my first investments. Bespoke comes up with these great boxes that house unique items that subscribers get to purchase before anyone else does. Often, people forget that men do like to shop and feel like they are finding out about something first. What I liked about this particular company was their idea: it was brilliant. In addition, they’re such a young company, and were profitable in their first year. When does that happen? Plus, I love the partners they have, especially Conde Nast, their image really aligns with our company principles.

Most humbling experience (relating to angel investing)?

I feel like, here we are, in this industry where we have all this experience and you almost feel like professionally you’ve reached your plateau. Now, however, you come into a whole new world and realize you absolutely know nothing. It’s such a humbling experience to get to learn all these new things, to be introduced to all these new sectors and new people, and to understand just how many amazing new ideas are out there.

What was the worst pitch you have seen so far?

Where they actually said something negative about their own company. He clearly was not ready to present. He didn’t know anything about his company. Another guy was supposed to come and help him present – he really should not have gone on with that presentation. Some people get really nervous presenting in front of celebrities. But some presenters come in, see these famous athletes, and they get a little star-struck, and nervous. I think they might be intimidated. But if you are the CEO of the company, you should be able to operate under any circumstance, to sell your vision to anyone.

What financial returns do you target for an angel investment?

I don’t want to lose anything (laughs). I would rather have a company with small, steady growth but that stays around than have a one-hit wonder that looks like it’s doing great and then, all of a sudden, it’s gone. That’s my worst fear. STAR has a really good screening process so that before it even gets to us, we know we are seeing successful people who have great ideas and who have created profitable businesses.

We are comfortable with companies that we can invest in at a $3M-$5M valuation that we feel have a good chance of getting at least a $50M exit. So we are usually looking for a 10x return on our money and hoping that the company can be sold within the next 3-7 years.

What makes you and your classmates different from the average angel?

What we hear in the pitches is that they really value the network. There is a “Cool Factor” when it comes to associating with certain kinds of celebs – the ones who have 5M or 6M Facebook followers. There are definitely additional benefits to engaging with current and former athletes, or with someone in the entertainment business.

Also, I think sometimes people are surprised by just how intelligent we really are, how engaged we really are, and how much we add value. STAR brings in the best of the best professors to teach our classes – from Columbia, UCLA, GW. Some of our professors have walked not knowing what to expect, but to their surprise, end up walking away saying that this has been the best MBA class they have ever taught. That says a lot.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

One area I am very interested in is robotics. Robots are still so corporate but will soon become a part of our everyday life, doing things we cannot. There’s so much potential there. It fascinates me.

What’s the best way for entrepreneurs to reach out to you?

Apply through the STAR Angel Network.

If you have questions, email Erica Minnihan here.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here

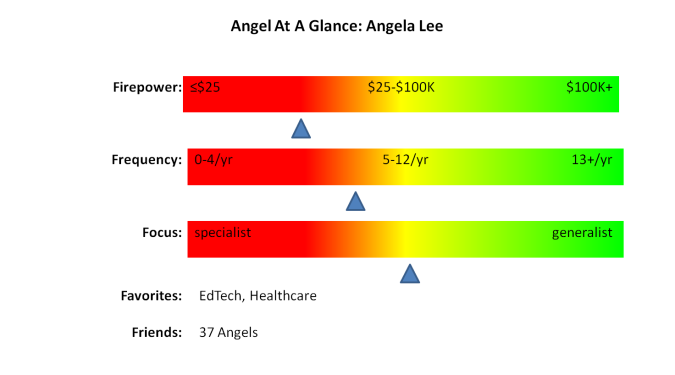

Angel Profile: Angela Lee

![]() Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. Here’s the original article.

Why do you angel invest?

I love helping early stage entrepreneurs as I’m an educator at heart. I’ve started several companies and like being able to share my experience to help other entrepreneurs. I think there are way easier ways to make money so if that’s your only goal, you should not be angel investing.

What was your first angel investment? How did it turn out?

It was a movie and something I felt very emotionally tied to. It raised the profile of mental illness in the Asian American community and was a Sundance finalist. When I heard about it, I said, “This is a movie that more people have to see.” Even if I lose all of my money on this one, I’m still glad I invested.

What investment do you most want to brag about / why?

One that’s doing very well is Legends of Fighting. It’s like Ultimate Fighting Championships (UFC), but in Hong Kong. They just raised a $4M Series A on a $13M valuation. They are on TV, selling broadcast rights. I know nothing about the space, but my husband and I went to school with the two co-founders, and they are both really smart guys and one knows the MMA space very well.

What’s your biggest lesson learned?

I relied on other investors too much at the beginning. I would think, “This person seems smart” so I trusted their due diligence probably more than I should have. I have gotten pretty far down the process and have been within days of writing a check and something didn’t feel right in my gut but I kept saying, “But this guy is invested in it and he must know what he’s doing.” To be clear, it is less about those people not being smart and more about my needing to get my feet grounded as an investor before I understood what my investment style was.

People often say that there are three types of investors. You either invest in the team, the market, or the technology. I am a team investor, I care about the team first and foremost most so it doesn’t make sense for me to rely solely on someone who cares first and foremost about the market they are playing in. That’s what my gut was telling me. For instance, I heard great company pitch yesterday and several people whose opinion I trust are interested. And even though I think the company will make a lot of money, I didn’t feel a connection with the team so I won’t be pursuing it.

What’s the smartest thing someone pitching you (or who you invested in) said / did?

The entrepreneurs that I like most are the ones that I say “no” to and they a) ask for feedback and b) three months later email me to show how they responded to the feedback. They stayed on my radar because they realized that this is not in any way, shape, or form a short term transaction. Maybe I missed their friends and family round; maybe I said no to their seed round, but guess what? Maybe I can introduce them to a Series A investor. That’s smart. This is a long term game.

What’s the dumbest thing?

“American Idol” reactions. You know, the “I’m gonna be a huge star one day and you’ll be sorry” type responses.

You run 37 Angels, a community of women angel investors. What’s the difference between men and women angels?

In general, I think women feel the need for a higher level of confidence before trying something new. They feel they need to know more about something before jumping in and their appetites for ambiguity can be low. This makes them less likely to go into angel investing and it’s why women angels have something of a reputation for taking a long time to pull the trigger.

At 37 Angels I try to a) increase this appetite for ambiguity, and b) help them do more effective due diligence, to get it down to five weeks instead of 5 months. We show them that there are different levels of due diligence, what to do, what not to do, etc.

How will you know when 37 Angels has succeeded in its mission?

When what people remember about me is not that I am a woman angel investor but rather that I am a healthcare tech investor who has deep expertise in the pharma industry. I’ll know I’ve succeeded when I walk into a room and people don’t automatically introduce me to the other woman in the room.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

Seamless, real-time health monitoring for preventative medicine.

What’s the best way for entrepreneurs to reach out to you?

Please go to the Entrepreneurs section of 37angels.com. You can also check out my Linkedin profile: @37angelsny.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here.

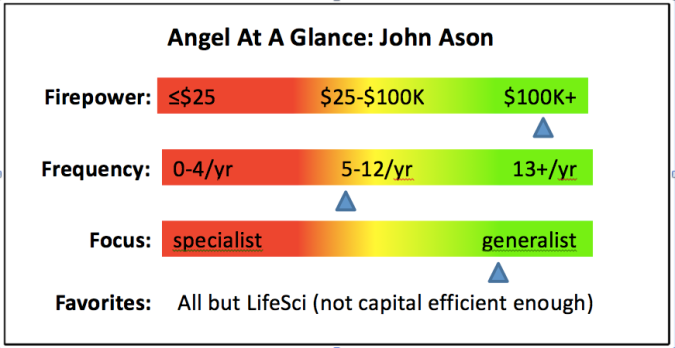

Angel Profile: John Ason

![]() Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. John’s profile went up a few weeks ago but I haven’t had a chance to post it here until now. Here’s the original article.

Note: Angel Profiles is a bi-weekly column appearing on AlleyWatch. John’s profile went up a few weeks ago but I haven’t had a chance to post it here until now. Here’s the original article.

What got you into angel investing?

I came out of AT&T Bell Labs, doing bleeding edge technology for 10 years, and then marketing and business management of large telecommunications projects sold overseas. So when I left, this was a natural extension of what I was doing AT&T. I made money in the stock market and apply the same discipline to angel investing: sell the losers and double down on the winners. Getting out of an investment is very difficult for most angels when the company is no longer viable as opposed to putting more money into it. I also play poker and most angels and entrepreneurs are good poker players.

What was your first angel investment? How did it turn out?

It’s either Xlibris or TuckerToys, I can’t remember. Xlibris, the first self publisher on the internet, sold about three years ago at a very nice profit. TuckerToys makes the Phlatball – over 15M sold, mostly overseas. TuckerToys produced a couple of great years of dividends and is still in existence.

What investment do you most want to brag about & why?

The two companies I am most famous for are Diapers.com and Bikini.com. People used to make fun of me for investing in Diapers.com because we were selling diapers on the internet… until Amazon bought it for $545M. And the really neat part was that I contributed absolutely zero to it, other than money and encouragement. It was like watching a really good movie. Marc and Vinit were super operational people and did not need any advice.

I like to mention Bikini.com because that humanizes me as an angel investor as opposed to those money hungry number crunching VCs. I need to have some fun too!

Notable train wrecks and lessons learned?

I’m proud of some of my train wrecks because I learned things from them. For example, MakeUsAnOffer was doing exceptionally well and then we got into some legal patent issues. We were probably in the right but couldn’t survive the lawsuit. Some things can’t be anticipated or planned for and you just don’t have the resources to handle.

Tell me about the startups that got away?

Never had one that got away. The closest I came to this was a company I wanted where a big VC did not want any other outside investors to get in. Ultimately, I got in indirectly through a VC fund where I am a limited partner. In most cases, the startups are just starving for cash; it’s almost always never the issue that it is so oversubscribed that you cannot get in.

Most humbling experience (relating to angel investing)?

Coming from Bell Labs, I assumed I could make anybody a good manager. But you can’t. At best you can influence them four or five degrees. You simply can’t make someone a good manager. That was my first humbling experience.

What impresses you about an entrepreneur?

I like someone who is clear, concise, compelling and elegant. I like to see an executive summary that fits on a single page with a lot of white space. And I love an idea that I have never seen before. Most ideas are retreads or rehashes.

Hotlist especially made an impression. They had amassed a massive database on events that people had gone to, were going to, or would be going to and there is a lot of location based services one can offer having that information. I had researched this area by doing due diligence on a few companies. Hotlist just had everything buttoned down and I made my decision in 28 minutes.

What turns you off to an entrepreneur?

Whenever people use the word “conservative” or “next generation.” I have a secret dictionary of these words which earn demerits and can disqualify the entrepreneur. This is how I “gamify” my investment process.

What makes you different from the average angel?

I like to invest in only industries that I know nothing about and I generally “let the dogs run.” I offer light overall guidance and try to introduce them to people who can help them. I am not an invasive investor.

Also, I mentor a lot. I have mentored companies which I did not invest in because they didn’t need the capital. I do it pro bono, because most entrepreneurs are nice people and in return I learn from the experience. I currently mentor 10 to 15 companies like this. They call me every four to six months for some advice or guidance and it’s usually a 15 to 20 minute session so it’s not a real time burner.

Recently, I’ve begun to mentor a number of international companies through Springboard and the Worldwide Investor Network. I also mentor women entrepreneurs through Astia & Springboard as well as women angel investors within Pipeline Fellowship, Topstone Angels, and 37angels. I have funded 11 female-founded companies, five of women were foreign born.

What financial returns do you target for an angel investment?

I aim for 10x returns. I say I want it within 3-5 years… although that’s never been achieved.

You have been angel investing for 17 years. How has it changed since you first started?

There has been a dramatic change over the past two or three years.

- The costs of starting a company are close to zero.

- The cost of proving the market with landing pages – sign up for the beta, sign up for a newsletter, answer a survey, stuff like that – is also close to zero. You can prove that there is a market without having a product.

- AngelList. I used to do 1 to 2 deals a year, very painfully. Finding a company was a big problem. Now AngelList has close to 19,000 startups on it so finding startups is not an issue. So is finding investors. In the past I used to syndicate deals. In my first 10 years, I knew everyone who invested with me intimately. Now, I tell my founders to list the company on AngelList with me as an investor and they assemble the rest of the syndicate. The majority of the other investors in my current deals are people I have never met.

- Accelerators like ERA, DreamIt and TechStars are producing large numbers of high quality, fundable companies.

- Super angels and micro VCs like John Frankel’s ff Ventures have a lot of cash for angel level companies, assisting in the fundraising process in a very positive way.

- Deal size. The average round until about a few years ago was $250K-$275K. It is now close to $650K. Many of these companies will skip their A round.

- International. The biggest response to my website comes from overseas asking me how they can invest in my companies and be angels in general. I received four investments into my companies. I have also received interest from foreign government organizations and universities on how to foster startup and angel ecosystems. We are also seeing a large number of foreign companies seeking funding.

Pretend that it’s 2019 and complete this sentence, “[Technology X] is less than 5 years old and now I can’t imagine life without it.”

Brainwave chips. There are several startups that let you control your computers with brainwaves and they are starting to get a little bit of traction. They have various devices that go over your head and with this one can control a device that provides input to a computer. As this industry matures miniaturization will occur that will lead to a brain chip.

Will they really implant these chips in their heads?

Why not? I have a defibrillator. I don’t want to carry one around so I had it implanted. They could put it on sunglasses, but fashion will win out and they will ultimately be implants.

What’s the best way for entrepreneurs to reach out to you?

Email me at ason@comcast.net but read my website first!

Also, check me out on AngelList, Linkedin, Twitter, Pinterest, Spling, Tip or Skip, & PRESSi.

If you are an active NY-area angel (or know someone who is) and would like to be profiled for AlleyWatch, please contact me here.